Investment Program

Our Approach

Achieving your philanthropic goals requires informed, strategic, and thoughtful investment choices. At Rose Community Foundation, our objective is to protect and grow the inflation-adjusted value of our portfolio over the long term while maximizing the impact of your investment. Since our founding in 1995, we have carefully stewarded charitable funds through a strategic and disciplined investment program.

Aligning Mission and Values with Investment Strategy

Investment returns are vital to our revenue model, ensuring the Foundation’s long–term stability and ability to support the Greater Denver nonprofit community. As a mission-driven organization, we recognize that every investment decision shapes our ability to fulfill our purpose. By thoughtfully selecting and managing investments to align with our larger vision, we strive to achieve strong financial returns while advancing broader community goals.

Mission and values-based investing allows us to use our investment dollars as a tool for positive change, aligning financial decisions with our core values. In partnership with our Outsourced Chief Investment Officer, we actively pursue investment themes that reflect our client’s values and priorities, collaborating with donors who share our commitment to meaningful, lasting change.

Oversight of Investment Portfolio

Rose Community Foundation’s staff, investment committee, and professional asset managers bring expertise and sound financial management to maximize your investment in the community.

Our investment committee is composed of board of trustee members and experts from the community. The committee works with global investment firm Cambridge Associates as the Foundation’s outsourced chief investment officer (OCIO).

Cambridge Associates is responsible for managing custom strategies for the Foundation’s investment pools. With over 50 years of experience, Cambridge Associates has built institutional-quality portfolios for renowned endowments and foundations across the country. They have a long history of helping clients integrate mission and values into their investment strategies without making concessions on returns.

Investment Options

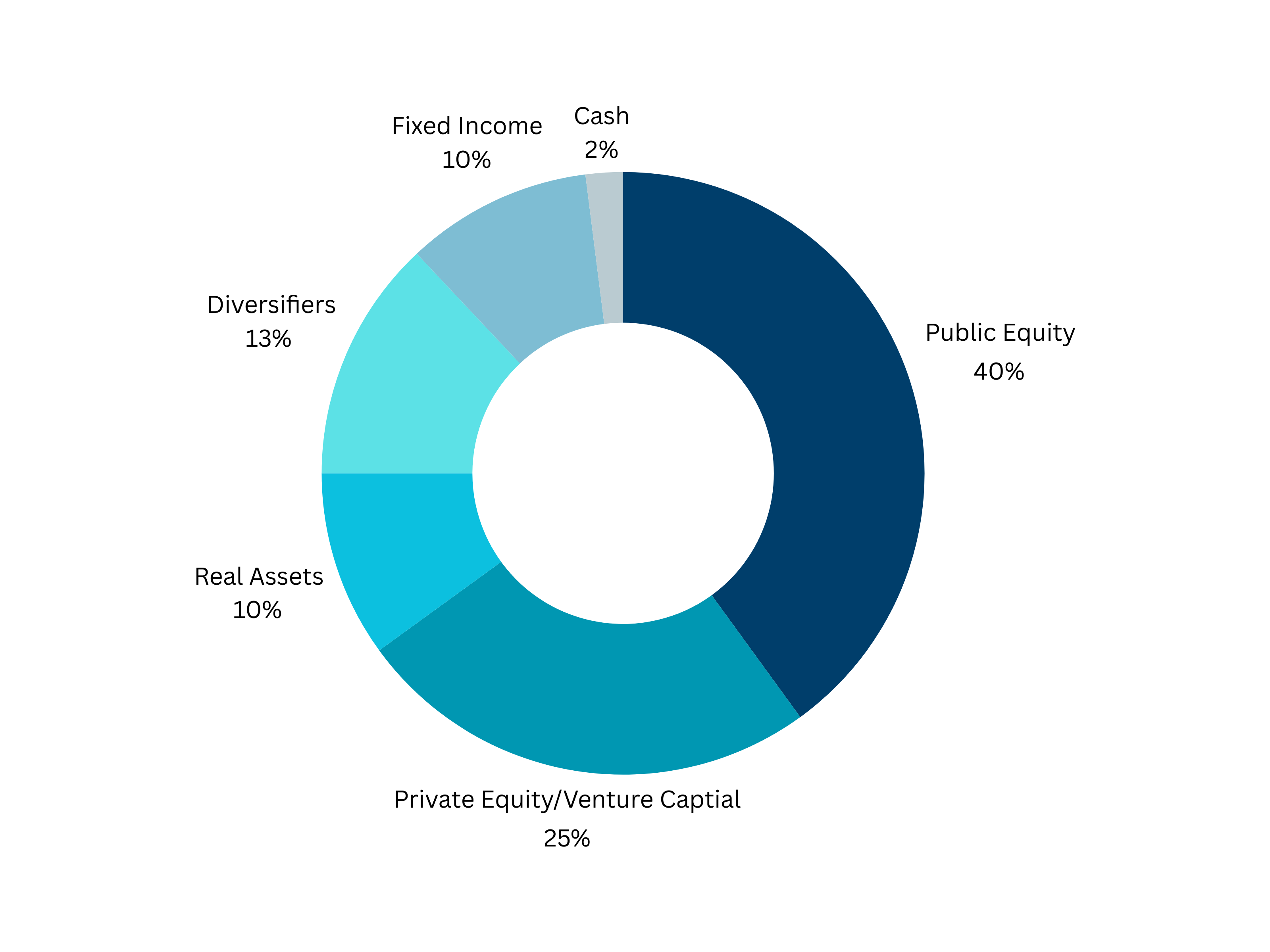

Growth Pool

Suitable for fundholders looking for a diverse investment portfolio for the long-term investment of charitable funds. Invested to provide safety through diversification in a portfolio of common stocks, bonds, mutual funds, alternative investments, and cash equivalents.

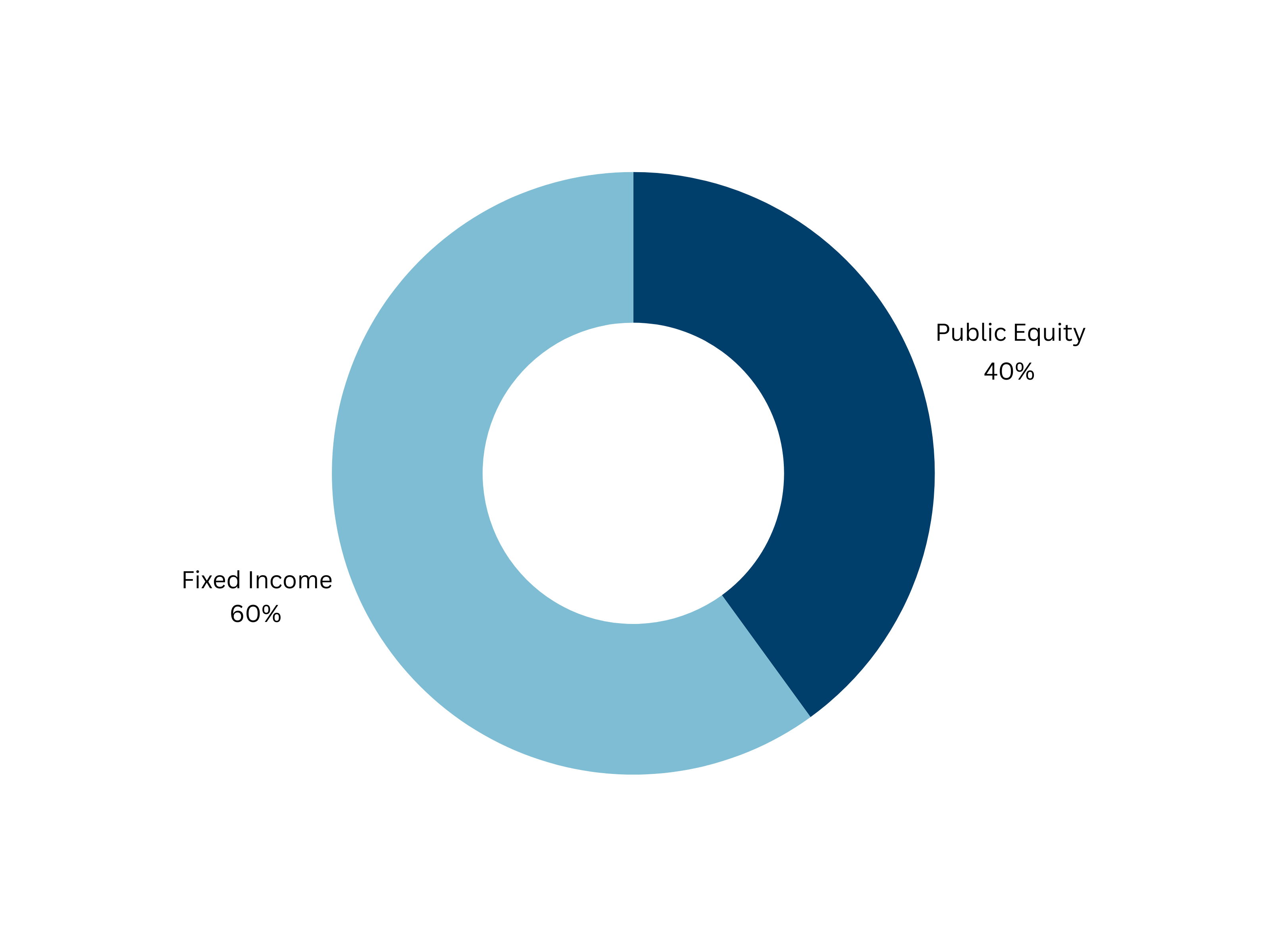

Balanced Pool

Falls between the Long-Term and Short-Term pool, offering fundholders a split between equities and fixed income and striking a balance between being positioned for moderate growth while not being exposed to substantial value-eroding risk. Invested in a portfolio of common stocks, bonds, mutual funds, and cash equivalents with Environmental, Social, and Governance criteria incorporated in decision making.

Money Market Pool

Designed to support short-term grantmaking goals and reflect donor preferences for investment risk. The money market pool includes investments in money market, commercial paper, corporate securities, U.S. Treasuries, etc.

Asset Allocation

Rose Community Foundation strategically manages investments to maximize returns and minimize risk. A balanced, diversified portfolio of stocks, bonds, mutual funds and alternative investments ensures that philanthropic capital is maximized through all market cycles.

Our Strategies

- Focus on the Long-term: Steady growth helps minimize risk to build lasting resources, rather than changing strategy based on short-term market conditions.

- Utilize Economies of Scale: Funds are combined for investments to leverage efficiencies. This allows smaller funds access to more sophisticated investment vehicles that might not otherwise be possible.

- Practice Portfolio Diversification: Diversification increases the likelihood of meeting or exceeding the fund’s desired return during market fluctuations.

- Track Fund Performance: Each fund is tracked individually. Comprehensive statements are issued on a quarterly basis, and all information is available anytime through the Donor Portal.

Learn More

If you’re interested in partnering with Rose Community Foundation for your investment needs, please reach out to our Philanthropic Services team. For existing fundholders, log in to your fundholder portal to manage your account and access additional resources.